Total retail sales post double-digit growth in May, with Department Stores, Jewelry and Luxury outperforming

PURCHASE, N.Y.--(BUSINESS WIRE)--

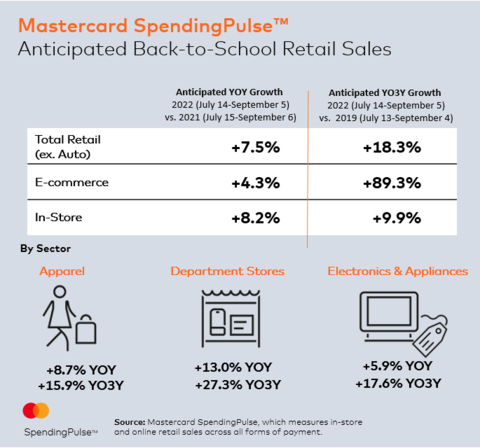

While inflation is impacting retail sectors and households in a myriad of ways, continued consumer demand contributed to double-digit growth across nearly all retail sectors in May. This is according to Mastercard SpendingPulse™, which measures in-store and online retail sales across all forms of payment, not adjusted for inflation. As we look ahead to the critical mid-July through Labor Day back-to-school period, U.S. retail sales are expected to grow 7.5% excluding automotive compared to 2021. Sales are anticipated to be up 18.3% compared to pre-pandemic 2019, with Department Stores expected to be a noteworthy winner as the sector continues its recent rebound.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220613005885/en/

Mastercard SpendingPulse: Anticipated Back-to-School Retail Sales (Graphic: Business Wire)

“Back-to-school is the second biggest season for retailers and is often looked at as an early indicator of retail momentum ahead of the traditional holiday season,” said Steve Sadove, senior advisor for Mastercard and former CEO and Chairman of Saks Incorporated. “While Mastercard SpendingPulse anticipates growth across sectors, retailers will need to find innovative ways to entice shoppers as discretionary spending potentially stretches thin as a result of increasing prices.”

This back-to-school season will be defined by the resilience and flexibility of the consumer. Ultimately, we’ll watch to see how they balance their desire for fresh styles and new experiences with continued price pressures. Anticipated retail trends for the 2022 back-to-school season include:

-

The In-Store Experience: Shopping for back-to-school becomes an experience of its own. From needing to try on new sizes to wanting to browse the latest fashions in person, the return to stores is expected to grow 8.2% YOY / 9.9% YO3Y this season.

-

Department Stores Continue their Rebound: Following a multi-year decline, department stores have made their way into the spotlight after 15 consecutive months of sustained growth. Serving as a one stop shop with a range of options for the whole family at a variety of price points, the back-to-school season is anticipated to drive the Department Store sector up 13% YOY / 27.3% YO3Y.

-

Stacked Social Calendars Drive Apparel Growth: More gatherings require more looks. With weddings, events and vacations lined up for the foreseeable future, the demand for apparel both in-store and online sees no signs of slowing, forecasted to be up 8.7% YOY / 15.9% YO3Y.

May Retail Sales Growth

According to Mastercard SpendingPulse, total U.S. retail sales excluding automotive increased 10.5% year-over-year in May, and 21.4% compared to pre-pandemic May 2019. This is outpacing YOY monthly growth experienced thus far in 2022. In-store sales were a key driver, up 13.7% compared to pre-pandemic levels.

“The continued retail sales momentum in May aligns with the sustained growth rates we’ve seen so far this year,” said Michelle Meyer, U.S. Chief Economist, Mastercard Economics Institute. “The consumer has been resilient, spending on goods and increasingly services as the economy continues to rebalance. That said, headwinds have become stronger - including gains in prices for necessities like gas and food, as well as higher interest rates."

*excluding auto

About Mastercard SpendingPulse

Mastercard SpendingPulse™ reports on national retail sales across all payment types in select markets around the world. The findings are based on aggregate sales activity in the Mastercard payments network, coupled with survey-based estimates for certain other payment forms, such as cash and check. As such, SpendingPulse™ insights do not in any way contain, reflect or relate to actual Mastercard operational or financial performance, or specific payment-card-issuer data.

Mastercard SpendingPulse defines “U.S. retail sales” as sales at retailers and food services merchants of all sizes. Sales activity within the services sector (for example, travel services such as airlines and lodging) are not included.

About Mastercard (NYSE: MA)

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. Our decency quotient, or DQ, drives our culture and everything we do inside and outside of our company. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

www.mastercard.com

View source version on businesswire.com:

https://www.businesswire.com/news/home/20220613005885/en/

Media Contacts

Alexandria Pierroz, Mastercard

914.260.1020 | Alexandria.Pierroz@mastercard.com

Avery Jaffe, Mastercard

914- 249-1771 | avery.jaffe@mastercard.com

Source: Mastercard Investor Relations